Tag: behavioral economics

Great Graph on Income Inequality

by chris on Oct.02, 2010, under general

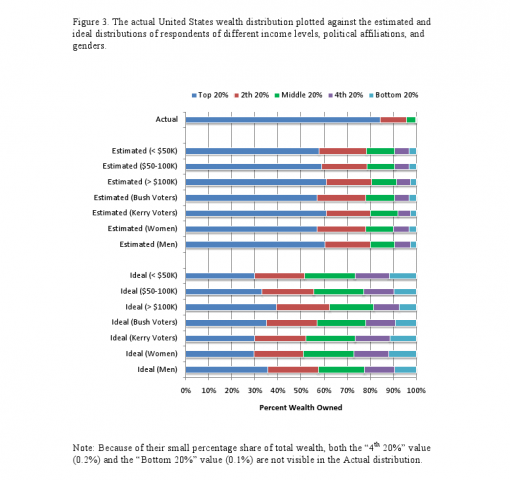

From Ariely et al, in an HBS paper describing perceived vs ideal vs actual distributions of wealth by income quintile.

Takeaway graph:

Bottom line: no matter what your income or political affiliation, you a) think the wealth gap is lower than it is and b) would prefer it to be lower than it is.

More Shoeboxes Stuff

by chris on May.28, 2010, under general

From Nudge blog:

The process of mentally bucketing money in multiple accounts is often combined with earmarking the accounts for specific goals…While it seems like an inconsequential process, earmarking can have a dramatic effect on retirement saving. Cheema and Soman (2009) found that earmarking savings in an envelope labeled with a picture of a couple’s children nearly doubled the savings rate of very low income parents.

The results by Cheema and Soman could explain why some US financial institutions offer clients the opportunity to label college savings accounts with a child’s name. Saving becomes easier because the money is earmarked for the education of a specific child.

I already do this with my dozen savings accounts from ING Direct – “Car”, “Rent”, “Groceries”, “Vacation”, etc – but it’s nice to have some more empirical validation for what I’m pushing.

In Search of Shoeboxes: Goodbye BoA, Hello ING!

by chris on Mar.03, 2010, under general

Readers of this blog will recall Saving With Shoeboxes: An Open Letter To My Bank, in which I reviewed some research from behavioral economics and suggested that banks might leverage the bracketing effect to help people visualize their budget. The general idea is that if you provide some structure which breaks up a pool of money into discrete chunks, people can actually budget better, because once you break down that $1000 of “free” money in your checking account into constitutive categories (groceries, utilities, etc), you’re much less tempted to blow it on an iPod.

I suggested that consumers could benefit if their banks allows users to create these ad-hoc, constitutive categories within a checking or savings account, and then allocate their total funds within these categories. Basically, if you could build your budget structure into the architecture of your online banking, you’d be able to bank better.

The post drew a fair response, in part because it was linked on Cass Sunstein and Richard Thaler’s NudgeBlog. And in the comments, a fair number of readers shared their stories, saying they’d been doing similar things for years with multiple checking accounts, or suggesting software packages like Mvelopes and BucketWise. And while these software packages have their perks – BucketWise, in particular, is almost exactly what I think the final solution should look like – they suffer from the disadvantages of disintegration from one’s actual online banking. Saving with shoeboxes should be simple and integrated into the process – it shouldn’t be disassociated and living on your desktop.

So I did the next best thing – I opened up about 8 checking accounts with Bank of America, and moved my money around within them. It wasn’t the simplest thing in the world, and getting 8 bank statements a month was sort of annoying, but it allowed me to improvise a crude shoebox system. Plus, checking accounts were free and easy to open online. And all was well for a time.

Note the past tense. Last week, Bank of America announced new monthly maintenance fees for checking and savings accounts that did not meet certain prerequisites (direct deposit, or a minimum balance of $1500 for the former and $300 for the latter). They launched a painfully kitschy “Facts About Fees” page, with a tiny talking woman named “Janet” strolling confidently onto my screen, explaining in a vaguely condescending tone stuff that was, in fact, unrelated to why these fees were suddenly necessary.

For most people, I admit, this probably isn’t an issue, as they most likely meet the minimum balance or direct deposit requirements on their one or two accounts. For me, obviously, it was unsustainable – I’d be paying upwards of $80 a month just for my budgeting system!

I tried calling Bank of America to see if they’d waive the fees. No dice. So I began looking around for other options.

I returned to the comments from that original post and found some promoting ING Direct, the online-only counterpart of banking giant ING. ING Direct, it seems, allows you to open up to 25 savings accounts for free, with no fees or minimums. Plus, they have “Automatic Savings Plans”, so one could say (for example) “Transfer $100 from my paycheck to my ‘Holiday Savings’ fund every month”.

Now, is this a perfect shoebox solution? Not at all. You still have to open several accounts, and you can’t easily allocate everyday expenditures within those accounts – you can only transfer money from “groceries” to “checking” to cover the expense.

(One of the keys to BucketWise is that you can allocate directly. Suppose you have $500 in your checking account, and $175 of that is devoted to grocery budget. You spend $50 at the grocery store on your debit card. When you enter that $50 into BucketWise, you can allocate it to your grocery budget. Now, your total account total goes down to $450, and your total grocery budget goes down to $125. This integrated allocation would be a killer feature to a true “shoebox” system in any online banking environment. I’ve been advocating a true design to anyone who will listen – and many who won’t. I’m still pushing for it as hard as I can. But I digress.)

However, ING Direct is much better at this sort of stuff than any other organization I’ve seen, including, unfortunately, MITFCU (I wanted to go Credit Union because of my distaste for banks, but apparently federal law does not allow individuals to open more than one checking/savings account per person, and MITFCU hasn’t gotten around to implemented a shoebox system as SDCCU has). So, for the last 24 hours, I’ve been transferring everything over to them.

While some aspects of the transition to an online-only bank aren’t easy – the two-day ACH waiting period, the comparable lack of ATMs, etc – so far I’ve been very satisfied. Their online banking portal is excellent, their rates are great, and the service is fantastic. It’s weird how weird it is to pick up a phone, call customer support, and be connected to an actual human being in two rings or less. I can’t even remember the last time I was on hold with Bank of America for less than 15 minutes.

When you include the fact that ING Direct will allow me to continue my (admittedly imperfect) implementation of the shoebox system, it’s really a no-brainer.

So if you’re out there, and want to try better budgeting, or about to get hit with ridiculous fees by comically money-grubbing financial institutions, I recommend ING Direct. I only wish I’d followed the advice of those comments before.

BucketWise

by chris on Feb.09, 2010, under general

Not to belabor the point, but the “bracketing effect” / “envelope model” for banking is still really, really important. The problem is that no banks will build it into their software (maybe they make too much money off overdraft fees?)

BucketWise is a free, simple, locally-hosted application that allows you to do it yourself. Take your general fund, allocate it among constituent funds, and budgeting becomes comprehensible. Watch the demo video.

Is it as convenient as having it built right into your online banking? No. But it’s better than nothing, and maybe it will finally convince someone that harnessing the bracketing effect for better budgeting is the killer app of online banking.

Envelopes Exist, Part 2

by chris on Aug.18, 2009, under general

Via Lifehacker: Mint adds ‘enveloping’ budgeting tools.

Envelopes Exist

by chris on Aug.10, 2009, under general

When I advocated some money management tools levering the bracketing effect in “Saving With Shoeboxes” I thought I was taking some obscure academic research and applying it in a novel, original way.

I should have known better.

Commenter “kevin” pointed me to mvelopes, an online third party money-management service that provides little envelopes in the way I described. Googling it, I found the Wikipedia page for “envelope system.” Turns out that, like so many things, our ancestors knew something we didn’t. The envelope system has been around for cash management since the 1930s.

There are several applications that will bring the bracketing effect to your banking. Someone even wrote a spreadsheet for it.

Check them out – and thanks Kevin!

Nudge

by chris on Aug.09, 2009, under general

I don’t normally post about pingbacks, but I got a shoutout from the Nudge blog today about my “Saving with Shoeboxes” post describing design improvements that might improve money management in online banking.

I’m posting to say that (wholly separate from the shoutout) if you haven’t read Nudge by Dick Thaler and Cass Sunstein you should. It’s a more developed version of their “Liberatarian Paternalism is Not An Oxymoron”, and compelling argues that certain tweaks – or “nudges” – to the defaults of different laws could enhance social welfare without limiting freedom. Good book, good argument, good way of thinking about the things public policy should concern itself with.

Saving With Shoeboxes: An Open Letter To My Bank

by chris on Jul.23, 2009, under rfc

Suppose you go to the movies. You buy a gallon bag of popcorn for $5. Your twin also pays $5, but she receives her popcorn in four sealed quart bags. You are both equally hungry, have equivalent stomachs, and have the same love for salty treats during showings of Up. Will you both eat the same amount of popcorn?

Probably not. At least, that’s the answer suggested by the behavioral economist Dilip Soman. I subscribe to the podcast Arming the Donkeys by Dan Ariely. On last week’s show, Dan interviewed Dilip about “The Effect of Bracketing on Spending“, cowritten with Amar Cheema.

The basic finding of Soman and Cheema is this: portions affect consumption. Nothing new to dietitians, perhaps, but definitely new to economists. Soman explains that, ceteris paribus, your twin will eat less than you, because putting the same amount of popcorn into different bags creates “brackets” that contextualize consumption. There’s nothing to stop you from eating all of the giant tub of popcorn, but the tiny barrier of opening the bag makes you think about how much you are eating and gives you the chance to reevaluate your total consumption.

Soman and Cheema found the same effect held true with gambling. Roughly speaking, give a gambler an envelope with $X, or give them 10 envelopes each containing a tenth of $X, and they will gamble differently. According to Cheema, partitioning this way can reduce spending by 50%.

Now, what on earth does this have to do with my bank?